Key Elements to Take Into Consideration When Looking For an Equity Loan

When thinking about looking for an equity funding, it is vital to navigate with numerous key elements that can substantially affect your monetary health - Equity Loans. Recognizing the kinds of equity loans offered, reviewing your eligibility based on monetary aspects, and meticulously analyzing the loan-to-value ratio are necessary first actions. The intricacy deepens as you dig right into contrasting rate of interest rates, charges, and repayment terms. Each of these aspects plays a crucial function in establishing the total expense and expediency of an equity lending. By carefully inspecting these elements, you can make informed choices that straighten with your lasting economic objectives.

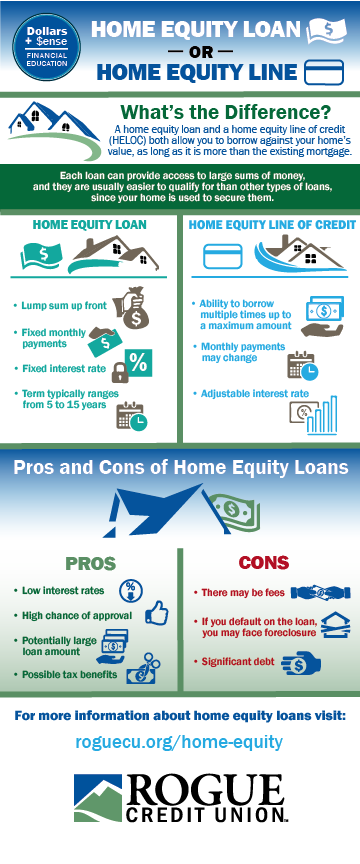

Sorts Of Equity Financings

Numerous monetary institutions supply a variety of equity loans customized to satisfy varied borrowing demands. One typical type is the standard home equity finance, where homeowners can borrow a round figure at a fixed rate of interest, utilizing their home as collateral. This sort of funding is suitable for those that require a big sum of cash upfront for a specific objective, such as home remodellings or financial debt consolidation.

An additional popular choice is the home equity credit line (HELOC), which functions a lot more like a credit history card with a rotating credit report limit based on the equity in the home. Debtors can attract funds as needed, up to a specific restriction, and only pay rate of interest on the quantity made use of. Equity Loans. HELOCs are ideal for recurring expenses or jobs with unclear costs

Additionally, there are cash-out refinances, where house owners can re-finance their present home loan for a greater quantity than what they receive the difference and owe in cash - Alpine Credits Canada. This type of equity funding is beneficial for those wanting to capitalize on reduced passion prices or access a big sum of cash without an added month-to-month settlement

Equity Loan Eligibility Elements

When taking into consideration eligibility for an equity finance, financial organizations typically evaluate variables such as the applicant's credit score, revenue stability, and existing debt commitments. Revenue stability is another crucial aspect, showing the borrower's capability to make routine financing payments. By thoroughly examining these variables, financial organizations can figure out the candidate's qualification for an equity financing and develop suitable car loan terms.

Loan-to-Value Proportion Factors To Consider

A reduced LTV ratio indicates much less danger for the lending institution, as the customer has more equity in the building. Lenders normally choose reduced LTV proportions, as they provide a better padding in situation the borrower defaults on the loan. A greater LTV ratio, on the various other hand, suggests a riskier financial investment for the loan provider, as the borrower has much less equity in the residential property. This may cause the lender enforcing higher rates of interest or more stringent terms on the funding to reduce the raised danger. Consumers ought to intend to keep their LTV proportion as low as feasible to improve their opportunities of approval and protect more positive lending terms.

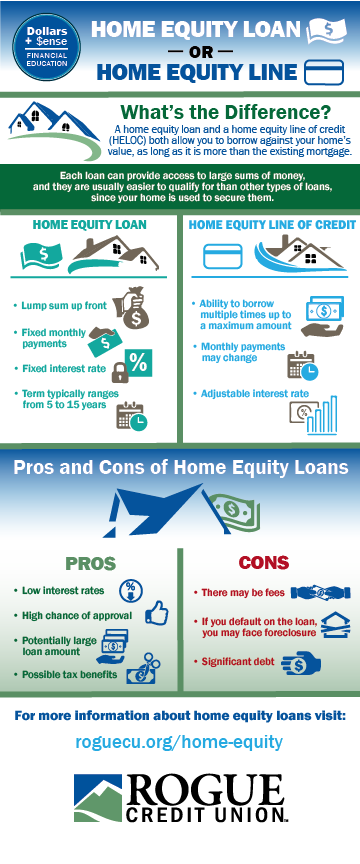

Rates Of Interest and Costs Comparison

Upon analyzing rate of interest prices and fees, customers can make educated decisions relating to equity loans. Rate of interest rates can dramatically impact the overall expense of the finance, influencing month-to-month payments and the overall amount paid off over the loan term.

Aside from rates of interest, consumers should likewise think about the numerous costs connected with equity fundings - Alpine Credits Equity Loans. These costs can consist of source fees, appraisal charges, closing expenses, and early repayment fines. Origination fees are charged by the loan provider for processing the finance, while assessment costs cover the price of analyzing the building's worth. Closing prices encompass various fees associated with finalizing the car loan contract. If the debtor pays off the finance early., early repayment charges might apply.

Settlement Terms Analysis

Efficient analysis of settlement terms is important for customers looking for an equity funding as it straight influences the funding's price and economic end results. The funding term refers to the length of time over which the customer is anticipated to pay off the equity financing. By thoroughly assessing payment terms, debtors can make educated decisions that line up with their financial objectives and guarantee successful funding administration.

Final Thought

To conclude, when applying for an equity funding, it is very important to think about the sort of lending readily available, qualification aspects, loan-to-value ratio, rate of interest and costs, and payment terms - Alpine Credits Canada. By very carefully reviewing these vital variables, debtors can a fantastic read make educated decisions that align with their economic objectives and scenarios. It is critical to extensively study and compare options to ensure the ideal feasible result when seeking an equity loan.

By thoroughly evaluating these variables, monetary institutions can establish the applicant's eligibility for an equity financing and establish suitable financing terms. - Home Equity Loans

Passion rates can dramatically affect the overall price of the car loan, affecting regular monthly payments and the complete amount settled over the car loan term.Reliable assessment of repayment terms is vital for borrowers seeking an equity loan as it straight affects the lending's price and financial results. The loan term refers to the length of time over which the debtor is expected to pay back the equity car loan.In verdict, when applying for an equity funding, it is vital to consider the kind of loan offered, qualification aspects, loan-to-value proportion, interest rates and costs, and settlement terms.

Comments on “Protecting an Equity Loan: Steps and Requirements Explained”